February 2026 Insights

Aspirations Wealth constantly monitors the investment markets and aims to keep our valued clients regularly informed and updated. We aim to help investors cut through all the media noise and hype and understand what is really driving investment markets and portfolio returns.

In this edition we cover:

RBA Increases Interest Rates

What Happened to Gold and Silver?

RBA Increases Interest Rates

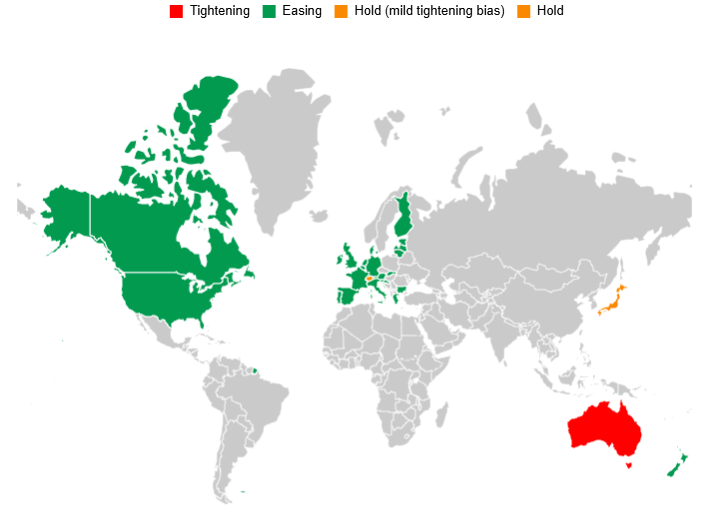

The RBA recently announced that the cash rate will be increasing by 0.25%, lifting it from 3.60% to 3.85%. This makes it the first major central bank to go from rate cuts to rate hikes following the post-COVID inflation spike.

The decision followed inflation data showing that price pressures remain higher than the RBA’s target range. Headline inflation was approximately 3.8% (year to December), above the RBA’s target range of 2-3%.

As reasoning for the rate hike, the RBA cited:

Growth in private demand, driven by household spending and investment.

Rising activity and prices in the housing market.

A tight labour market.

What This Means Going Forward

At current levels:

Interest rates are now more restrictive, meaning they are designed to slow economic activity rather than support growth.

Further rate increases are possible but not guaranteed, and will depend on whether inflation falls towards the target range of 2-3%.

Looking ahead:

Borrowing costs are likely to remain elevated for some time, even if rates do not rise much further.

Any future rate cuts are unlikely until inflation is convincingly back within the 2-3% range.

Cash and term deposit rates are likely to stay relatively attractive while rates remain high.

In practical terms, the next phase is less about rapid rate rises and more about how long rates stay at these levels.

What Happened to Gold and Silver?

After strong rallies in late 2025 and early 2026, precious metals suffered a sharp drop on Friday Jan 30.

Gold fell more than 9%, falling from $5,390 USD an ounce to $4,895, its steepest single-day decline since the early 1980s. Silver suffered an even sharper decline, falling as much as 35% midday for its largest one-day drop on record. It closed the session down 26% at $85 USD an ounce, down from an opening price of $115. Despite these declines, both metals still closed out January at a higher value than they began the month.

The main drivers behind the decline were:

Changes in expectations around future central bank policy, particularly in the US, following Trump’s appointment of Kevin Warsh as the next federal reserve chairman.

A stronger US dollar, which tends to put downward pressure on precious metals prices.

Investors taking profits after unusually strong gains.

What This Means Going Forward

The sell-off did not call into question gold and silver’s role as long term safe havens, but it did show that even defensive assets can turn volatile when investors rush into the same trade simultaneously.

Gold and silver prices are closely linked to inflation expectations, interest rate outlooks & currency movements. They also have appeal as a safe haven during times of geopolitical tension and policy uncertainty.

If inflation re-accelerates, confidence in currencies weakens, or further geopolitical shocks occur, demand for gold and silver could increase again. If inflation continues to fall and rates remain high, upward pressure on prices may be limited.

Any advice contained in this insight/update is general advice only and does not take into consideration the reader’s personal circumstances. To avoid making a decision not appropriate to you, the content should not be relied upon or act as a substitute for receiving financial advice suitable to your circumstances. When considering a financial product please consider the Product Disclosure Statement. Aspirations Wealth Group is a Corporate Authorised Representative of Aspirations Private Wealth Pty Limited. ABN 57 622 182 076 – AFSL 503889.