July 2025 Insights

AW constantly monitors the investment markets and aims to keep our valued clients regularly informed and updated. We aim to help investors cut through all the media noise and hype and understand what is really driving investment markets and portfolio returns.

In this Insight we cover:

Portfolio valuation changes - end of financial year

Investment market returns for FY2025

Superannuation changes

Portfolio valuation changes - end of financial year

It happens every financial year in the first two weeks following the 1st of July.

Some of the funds in your portfolio pay distributions, say $5,000.

The capital account value of that fund goes down by the same amount.

The distribution payment takes approximately a week to be processed back to your account, and in the meantime, it appears as though your portfolio has lost money.

All is good, keep an eye on your portfolio over the coming weeks and you’ll see the balance increase from the distribution and the portfolio will resume its’ regular balance.

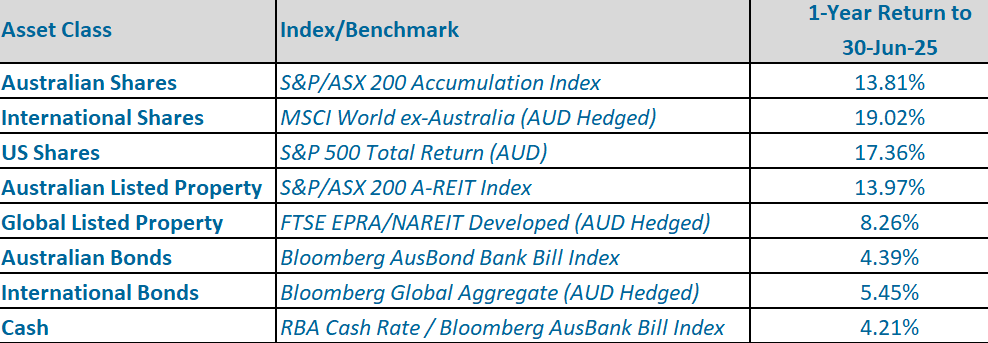

Investment market returns FY2025

The Financial Year 2025 showcased another period of good returns across most assets.

The short-term outlook for shares is mixed due to high valuations, as markets are now priced for perfection. When we see some economic and political bumps along the way, which we always do, markets may turn volatile. However, over the next 36 months, shares are poised to benefit as Trump shifts towards more market-friendly policies. Additionally, the USA Federal Reserve is likely to cut interest rates, possibly starting in September and we anticipate the RBA may reduce interest rates 2-3 times over the next six months, bringing the Aussie cash rate to approximately 3%.

Superannuation changes

Here are the key superannuation changes in Australia for the 2025/2026 financial year, effective from 1 July 2025:

Super guarantee (SG) rate increased from 11.5% to 12%, marking the final legislated rise.

Concessional (pre-tax) contributions cap remains at $30,000.

Non-concessional (after-tax) contributions cap remains at $120,000.

Non-concessional bring-forward rule: Remains at $360,000 over three years.

Transfer balance cap (maximum amount you can have in pension phase) increased from $1.9 million to $2 million.

An additional 15% tax on earnings for superannuation balances exceeding $3 million.

Any advice contained in this insight/update is general advice only and does not take into consideration the reader’s personal circumstances. To avoid making a decision not appropriate to you, the content should not be relied upon or act as a substitute for receiving financial advice suitable to your circumstances. When considering a financial product please consider the Product Disclosure Statement. Aspirations Wealth Group is a Corporate Authorised Representative of Aspirations Private Wealth Pty Limited. ABN 57 622 182 076 – AFSL 503889.