October 2025 Insights

Aspirations Wealth constantly monitors the investment markets and aims to keep our valued clients regularly informed and updated. We aim to help investors cut through all the media noise and hype and understand what is really driving investment markets and portfolio returns.

As financial markets continue to show strength—despite inflation concerns, geopolitical tensions, and policy uncertainty—many investors are asking: Is a market correction coming? And more importantly: Are we ready for it?

At Aspirations Wealth, we are ready.

While September and October have historically been the most volatile months for equities, corporate fundamentals remain strong. Earnings have outperformed market expectations, and sectors like technology and healthcare continue to show resilience. However, investor sentiment is increasingly cautious, and elevated valuations suggest that volatility may be ahead.

Here’s how we’re preparing:

1. Diversification remains key. At Aspirations Wealth we are actively reviewing client portfolios to ensure exposure to asset classes and sectors is appropriate for your goals and risk appetite. Where necessary, we are making adjustments to portfolio positions.

2. Bucket Strategy: For clients who need to draw on their investments for living expenses or upcoming costs, we employ a bucket strategy. This portfolio is defensively invested in short-term cash and fixed interest investments, ensuring that funds are available when needed without the concern of needing to sell growth investments at an inopportune time (i.e. when markets have fallen).

3. Active Managers: The majority of our clients' portfolios include Active investment managers. In the event of a correction, these managers are actively scouring the market to seize opportunities to purchase high-quality companies at reduced prices.

4. Hedging: We have also recently increased the level of hedging in our portfolios to protect the returns from the international portion of your portfolio from a rising Australian Dollar.

5. Using spare cash to Buy: When stock markets dip it presents an excellent opportunity to acquire high-quality assets at more attractive prices. If this strategy aligns with your financial goals and you have spare cash, your adviser will discuss potential opportunities as they arise.

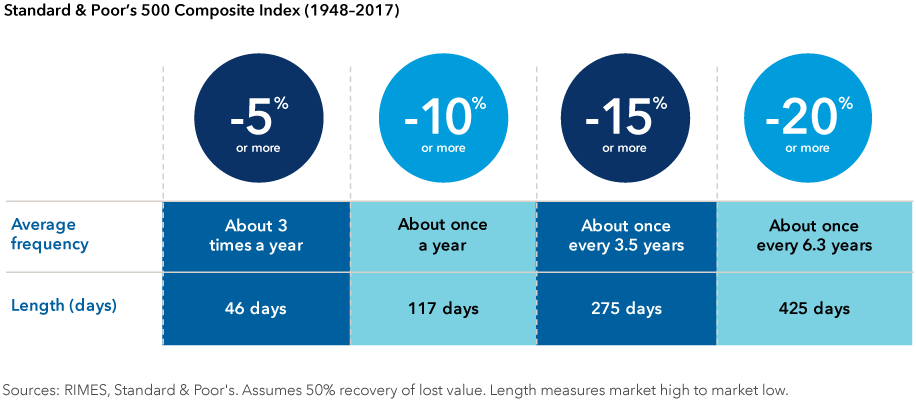

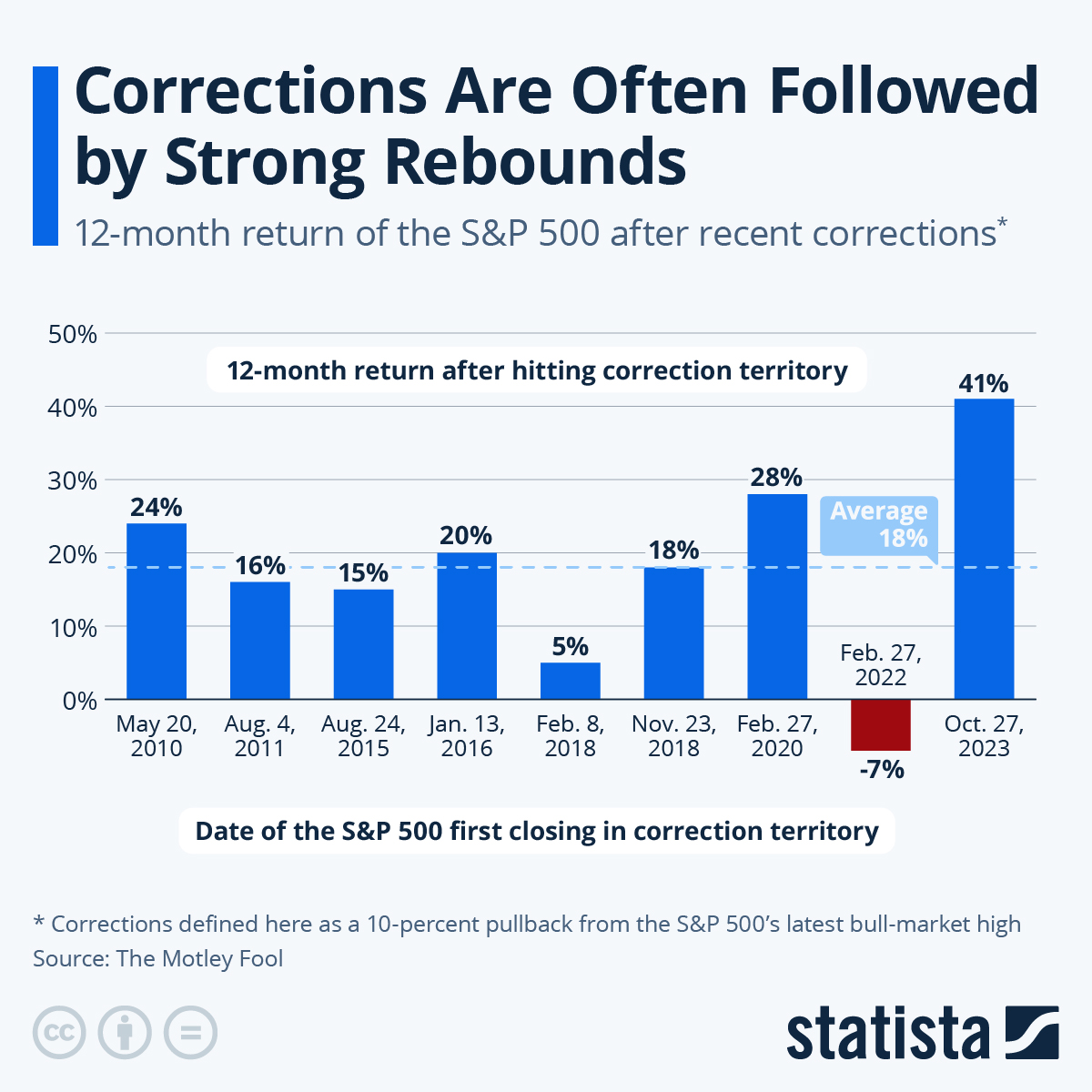

Below are illustrative images showing the frequency of market corrections and the typical rebounds that follow:

Market corrections are a natural part of the investment cycle. With a disciplined approach and proactive planning, they can be navigated—not feared.

We’re ready.

Any advice contained in this insight/update is general advice only and does not take into consideration the reader’s personal circumstances. To avoid making a decision not appropriate to you, the content should not be relied upon or act as a substitute for receiving financial advice suitable to your circumstances. When considering a financial product please consider the Product Disclosure Statement. Aspirations Wealth Group is a Corporate Authorised Representative of Aspirations Private Wealth Pty Limited. ABN 57 622 182 076 – AFSL 503889.